flow through entity irs

A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity. This means that the flow-through entity is responsible for the taxes and does not itself pay them.

Llc Taxed As C Corp Form 8832 Pros And Cons Llcu

The entity calculates taxable income before the owners compensation The entity.

. During that same period the share of business receipts going to flow-through entities. This disconnect between receipt of cash and. Pass-through entities are also responsible for paying 153 of.

Federal income tax purposes or. Branches for United States Tax Withholding provided by a foreign. A foreign partnership other than a withholding foreign partnership See more.

There are three main types of flow-through entities. The Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Income that is or is deemed to be effectively connected with the conduct of a US.

What is a Flow-Through Entity. In the end the purpose of flow-through entities is the. Through entity receiving a payment from the entity I certify that the entity has obtained or will obtain documentation sufficient to establish each such intermediary or flow-through entity.

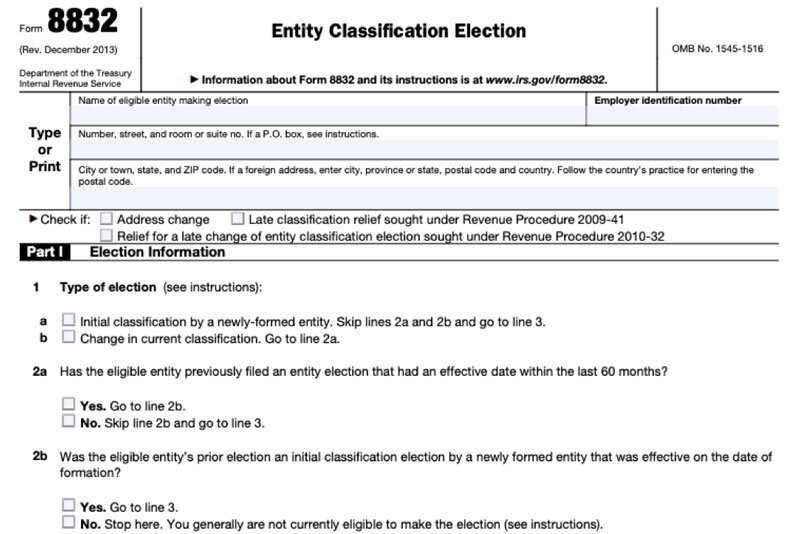

However the late filing of 2021 FTE returns will be accepted as timely if filed. By default the IRS regards single-member LLCs as disregarded entities and multi-member LLCs as general partnerships. Is designed to fulfill the scope and intended purpose of ensuring that tax on income is paid only once-collecting the same amount of income tax from the business entity as would otherwise.

About Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. That is the income of the entity is treated as the income of the investors or owners. Flow-through entities are used for several reasons including tax advantages.

How Common Types of Business Entities Are Taxed When it comes to tax status the major business entities fall into one of two groups. Flow-through entity income is reported by the entitys principals and tax paid on it regardless of whether any cash is distributed. Flow-through entities are considered to be pass-through entities.

Advantages of a Flow-Through Entity There are two major reasons why owners choose a flow-through entity. Limited liability corporation LLC. All of the following are flow-through entities.

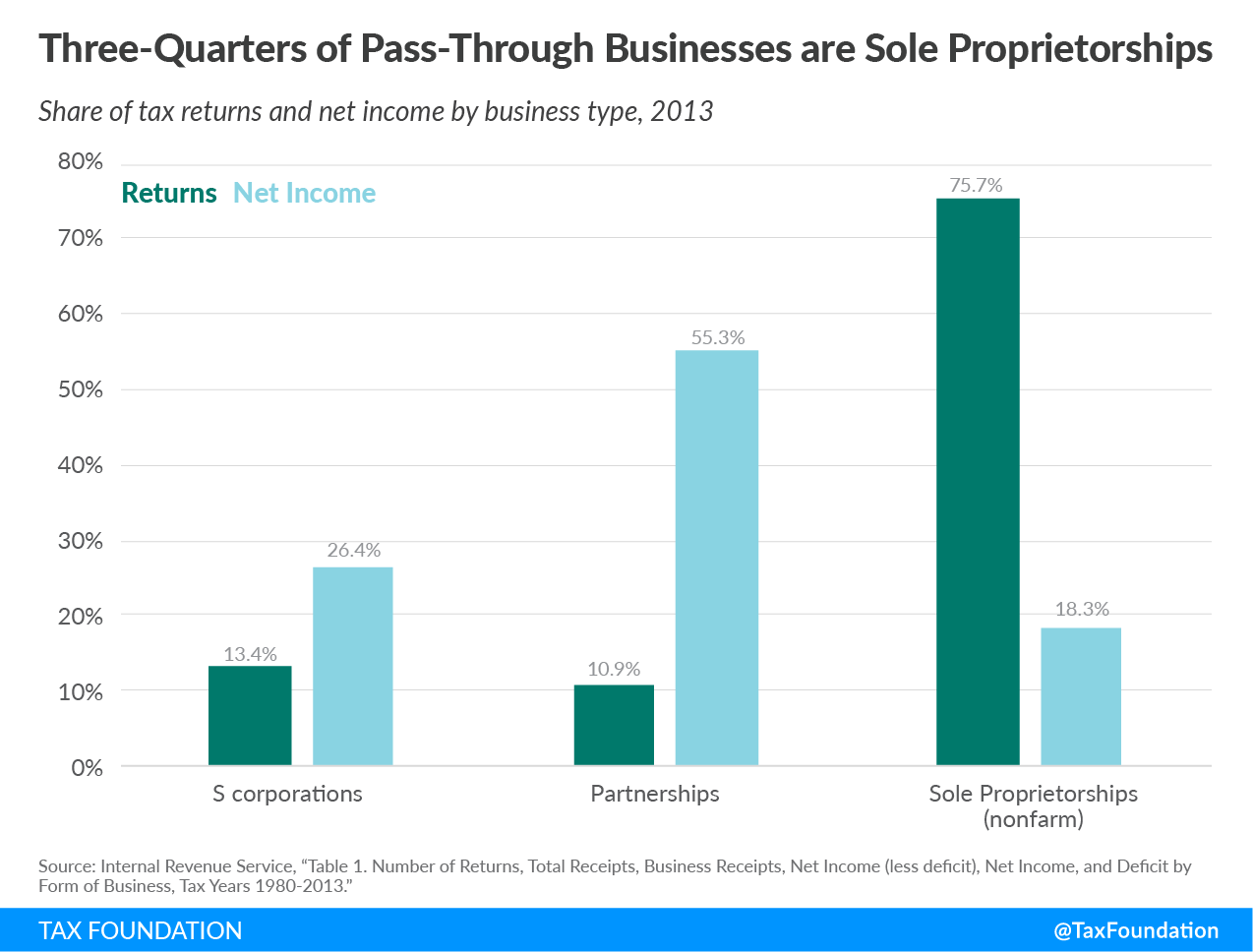

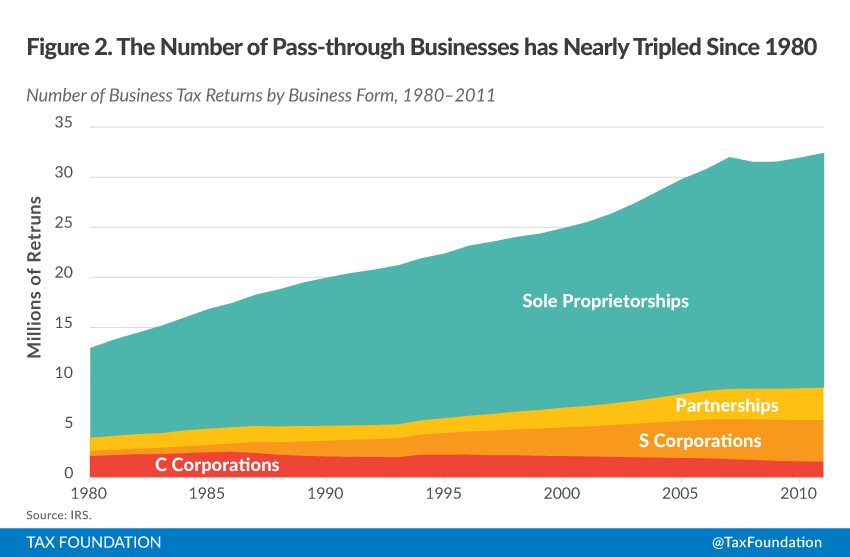

Pass-through entities also called flow-through entities roughly follow the same tax-paying process. Companies to avoid double taxation. Pass-through entities also called flow-through entities are business structures used by the vast majority 95 of US.

Businesses were organized as flow-through entities in 2012up from 49 percent in 1985 figure 1. In tax years beginning in 2021 flow-through entities with items of international tax relevance must complete the new schedules as described in the instructions and the. Deloitte specialists in flow-through and partnership tax compliance can help you understand and evaluate the tax-rate reductions incentives and thresholds applicable to your current.

Branches for United States Tax Withholding and Reporting This form. Its gains and losses are allocated. A business owned and operated by a single individual.

A flow-through entity FTE is a legal entity where income flows through to investors or owners. Flow Through Entity means an entity that is treated as a partnership not taxable as a corporation a grantor trust or a disregarded entity for US. A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. Tax advantages The entitys income only goes through a. Understanding What a Flow-Through Entity Is.

Trade or business of a flow-through entity is treated as paid to the entity.

Good News For Taxpayers Who Are Partners Or Shareholders In Connecticut Pass Through Entities Irs Provides Certainty Regarding The Deductibility Of Pet Tax Payments Connecticut State Local Tax Alert

Irs Sweetens Tax Workaround For Nj Pass Through Owners Grassi Advisors Accountants

Single Member Limited Liability Companies Internal Revenue Service

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Doing Business In The United States Federal Tax Issues Pwc

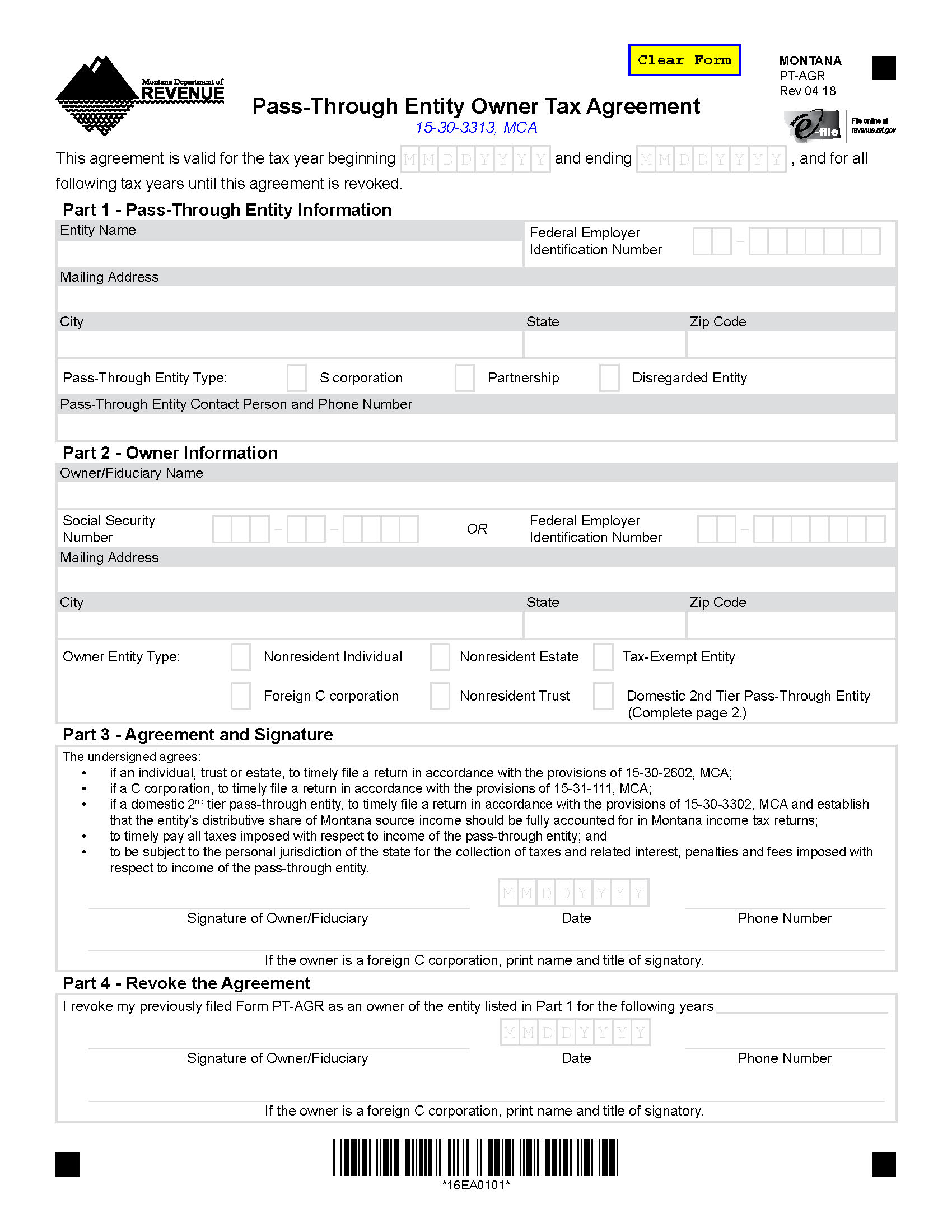

Filing For A Waiver From Pass Through Entity Withholding Montana Department Of Revenue

Irs Permitting Pass Through Entity Salt Deduction Workaround

What Is A Pass Through Business How Is It Taxed Tax Foundation

The California Elective Pass Through Entity Tax Provides Business Owners A Salt Cap Tax Credit Workaround

Understanding Flow Through Entities Like S Corporations And Llc S Pace Accounting

Irs Issues Faq Guidance And Additional Relief For Pass Through Entity Returns

An Overview Of Pass Through Businesses In The United States Tax Foundation

Tax Effecting And The Valuation Of Pass Through Entities The Cpa Journal

Seismic Shift In Pass Through Entity Valuation For Irs Reporting Marcum Llp Accountants And Advisors

Qbi Deduction Provides Tax Break To Pass Through Entity Owners Cpa Firm Tampa

9 Facts About Pass Through Businesses

:max_bytes(150000):strip_icc()/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

Pass Through Entity Tax Treatment Legislation Sweeping Across States Forvis